I’m writing this because a close friend of someone that I know recently deceased, and I’m going to recommend to them that they may want to take these steps to prevent any unauthorized use of the decedent’s credit.

All three credit bureaus offer a service now called a “Credit Freeze”, which means what you probably think it does. It means that if someone tries to obtain credit using that file, the lender will quickly be made aware that no new credit should be extended to the named individual. This is often important to do because it can take years in some cases for news of someone’s passing to reach some creditors.

And, if there are existing credit lines it is very important that these lines of credit are not used for new purchases, as this can have legal repercussions. Obviously, automatic payments sourced from a credit card aren’t viewed as malicious, but if you go and buy a new TV with the card then it’s likely to be scrutinized at some point.

If you have the cardholder’s personal information, you can probably call the card issuers and ask them to cancel the card. But typically, if you tell the bank that you’re not the cardholder then they are going to want you to fax them a copy of the death certificate. Additionally, they will want a document that grants you power of attorney or legal rights to this individual’s estate. How they handle outstanding balances is a little outside of what I’m writing about here, but typically this is handled during probate or settlement of a trust, if applicable.

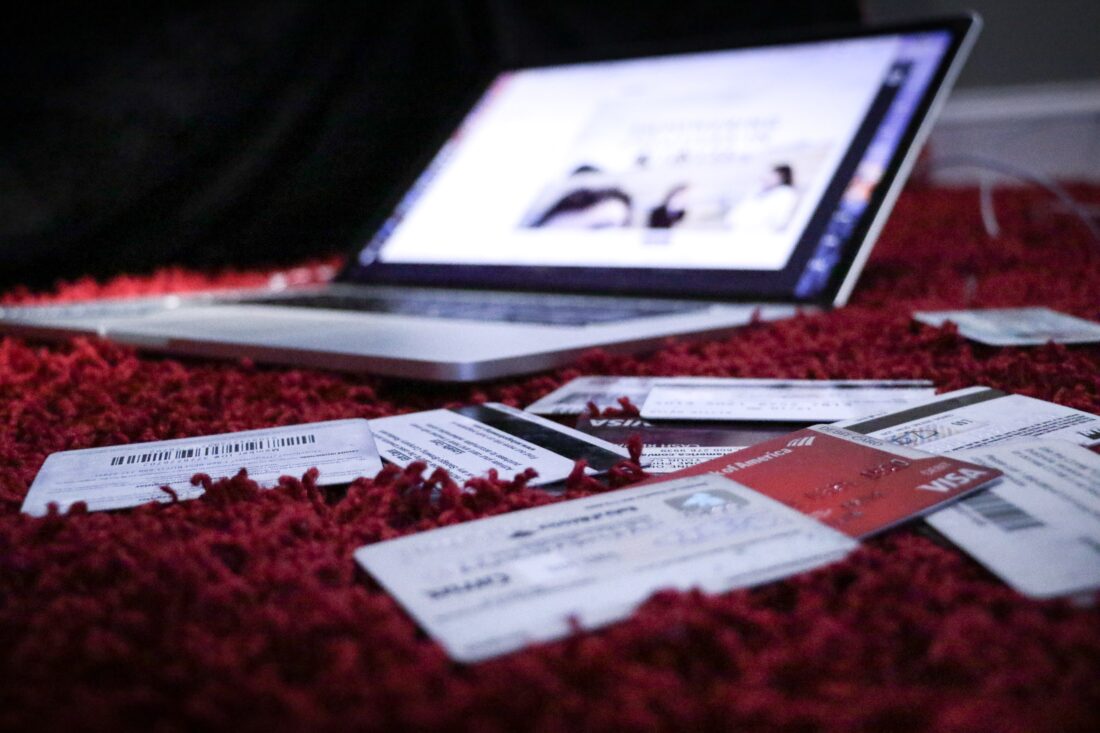

Things can get messy if preventative steps aren’t taken, and a family member gets ahold of the decedent’s credit card. Too often, abuse of this kind isn’t realized until it’s way too late and many times becomes criminal.

Here’s what you’ll need to place a freeze on the credit file, generally:

Social Security Number.

Date of birth.

Address at time of death

With this information, you can call or use the links to visit each of the three credit bureaus in order to apply the freeze to the file:

Equifax: 800-349-9960 or click here for the Equifax credit freeze page.

Experian: 888‑397‑3742 or click here to view the page online

TransUnion: 888-909-8872 or click here to do this online

It may also be prudent, prior to placing the freeze on the files, to obtain a free copy of all three credit bureau reports. With this information, you’ll be able to see what lines of credit are outstanding/open in the person’s name. Included also will be the most recent balance, credit line total, and other information. You are entitled to a free copy of all three bureau reports annually — available by visiting AnnualCreditReport.com. Please know that you will not need a credit card for this service, and you must be very careful not to opt in to any “monitoring” services or other “add-ons”. They try very hard to get you to do this. Your best bet is to visit this website on a desktop or laptop so you can see the whole page more easily.

As a side note, the AnnualCreditReport service above does offer the reports mailed to you in Braille, large print or audio format. Here’s the information they provide for persons in that category:

For the Deaf or hard of hearing: Call 7-1-1, refer TDD Relay Operator to 1-800-821-7232

For the blind: Call 877-322-8228

This was intended to be a quick post including just the phone numbers for the credit bureaus, but I ended up typing a little more than I expected. Hopefully this is helpful to others! And if you have comments then send them my way!