As I mentioned in my last post, I’ve referred a good handful of my clients over to Visible since their inception and I’ve made many observations as things changed with them during this time period.

I’m going to share these observations in hopes that they may alleviate your frustrations or help you get a problem resolved if you’re having any issues.

Visible has always had some pretty lucrative offers associated with buying a new device, or even bringing your own device. The nice part of this was that it was all automated based upon your meeting the criteria. For the most part, anyway. I did have one instance where it was painful to get the offer fulfilled, but otherwise it’s been pretty straightforward. You would choose your carrier during the ordering process, enter your account number, PIN, and ZIP code as needed for the port process. It worked pretty well, as when you went through activation your number transfer was initiated immediately. Anytime there were problems, your service was just inactive while the issues were resolved.

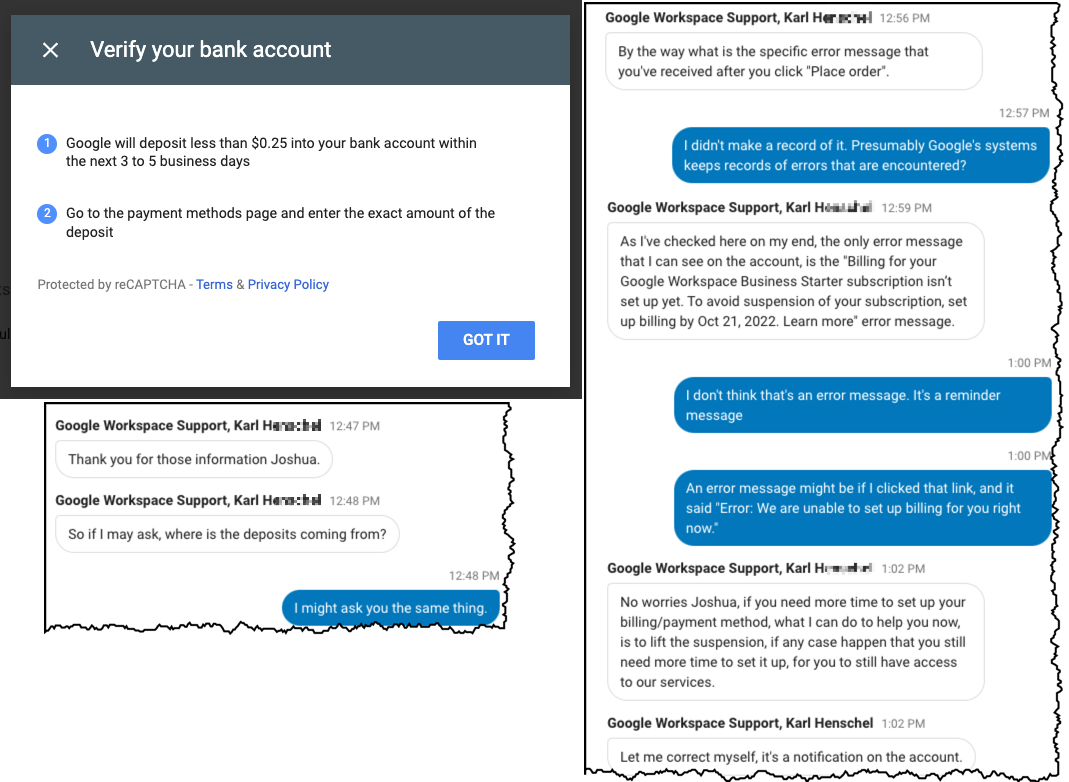

I had the pleasure of placing an order for someone just as they removed the ability to port your number during the ordering process. When I asked a customer service rep about this via chat, they told me, “Yes, that’s strange. I’ve had a few other people mention this as well. I would just go ahead with getting a new phone number, then get back with us when you receive the device and we can start the transfer for you. Oh, and we’ll also need documentation from your previous carrier to submit for manual processing of your rebate claim.”

When reviewing the pros and cons of their having the number transfer option during the order process, it becomes clear that they have all of the advantage by doing so.

#1) You’re much less likely to get your rebate offers fulfilled by going through the manual processing steps required, gathering bills and submitting them, etc. after the fact.

#2) You’re left on the hook paying for service when you can’t use it, if they are busy or anything goes wrong during the port. This has happened all three times that I’ve activated someone using this new process. The first time, their support was so busy that they didn’t respond to me for 3 days. I couldn’t even get into the queue for support via the website, so I had to use social media.

#3) If it turns out you can’t port your number for whatever reason, they’ll have gotten you for a month of service at least. You might be able to return the phone and get a refund for the service if you wanted to.

#4) It’s frustrating as can be to have to communicate with them via chat when they are so busy. Now they claim to have transfers set up in a “Do-it-yourself” fashion within the app.

Why the need for such shenanigans anyway? Why not just have the information in-place ahead of time, like you originally did? My guess is that they get to boost their carrier numbers by activating all of these numbers that only get used for a short period of time. Whatever the reason, it surely isn’t to make things easier for the customer.

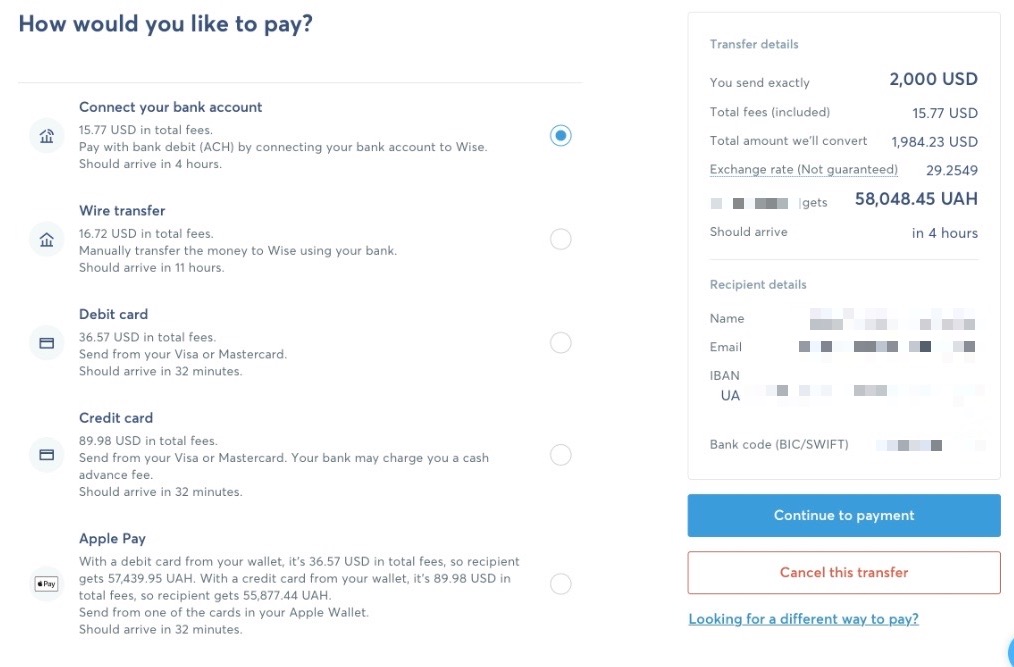

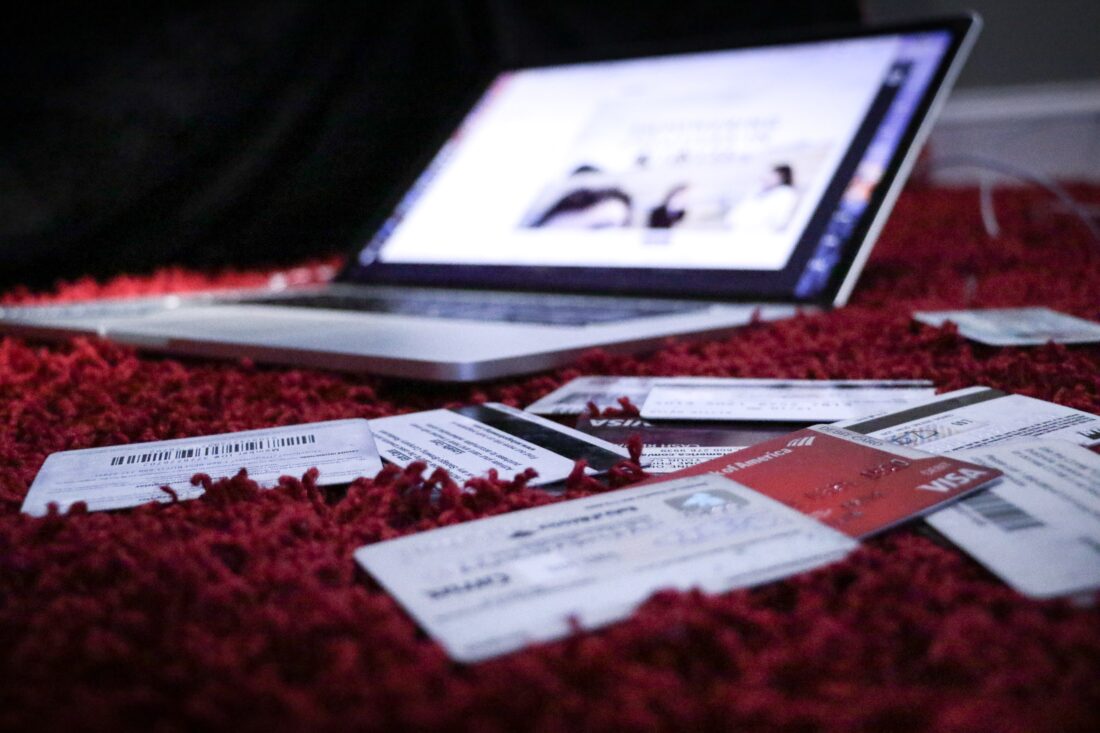

Another irritation I’ve found is that Visible’s website refuses the majority of payment methods without any reason. American Express cards don’t work at all on their site, always an error. Other cards very often don’t work unless you go through Venmo or PayPal. But they have their PayPal connection set up such that American Express is excluded from the options within PayPal. Oh, they’ll take AmEx with no issue for service payments. But when it comes to paying for a device, that extra 0.5% is just too much for them so they make up a random error to keep people at bay.

So at the end of the day, Visible works pretty well most of the time. But here are some of my recommendations to keep headaches away:

#1: Don’t bother trying to use American Express on their site

#2: If at all possible, link your credit/debit card to PayPal and pay using PayPal. If you’ve set up a new account for this purpose, make sure you verify your email address.

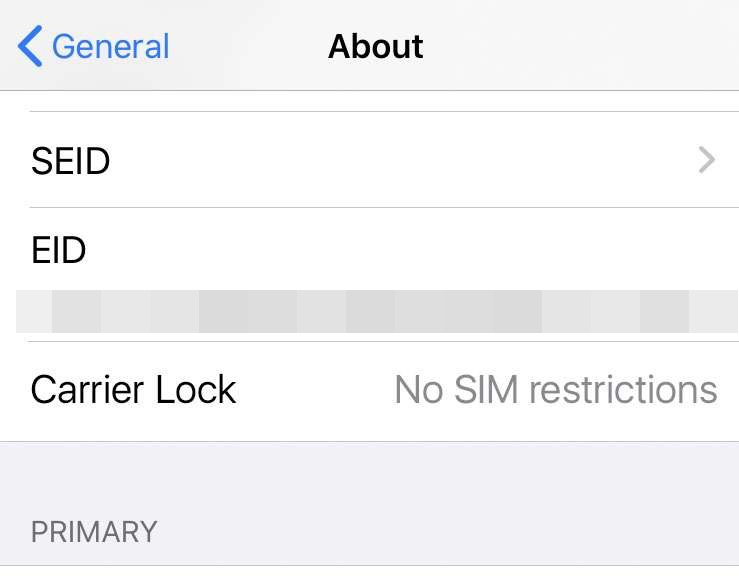

#3: Be careful with your eSIM. If you accidentally delete it, you’ll likely have to chat with support to ask them to send it to you again.

#4: Verify your email address with Visible. You won’t be able to activate until you do this step. Don’t open the Visible app on your new phone until you’ve done it. If you did open it, uninstall and reinstall it.

#5: First, try chatting with Visible on their website using the chat icon in the bottom, right. If you get into the queue and see that there are 30+ people waiting, then I’d suggest you send them a Direct Message on Twitter instead. Make sure to message the correct account, @VisibleCare. Or use the links I included below.

Here’s a few direct links to send them a Twitter DM, with a template for the information they need from you. Click for either General Problems or Number Transfer

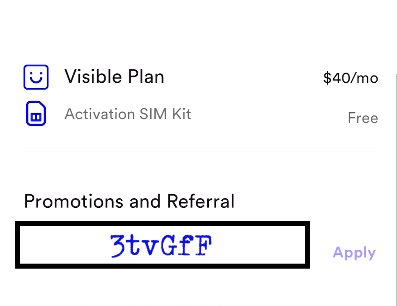

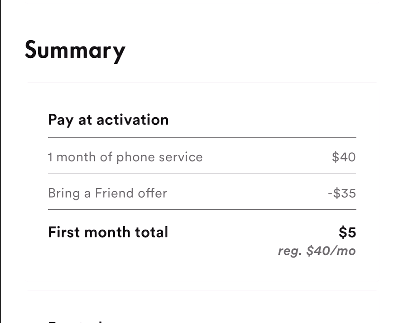

P.S. If you want to get $20.00 off your first month with Visible, you can enter this code within the Promo code box during checkout. Make sure to use the same capitalization that I’ve used:

3tvGfF

Sorry for yet another rant, but I feel obliged to share these kind of experiences so others out there don’t feel alone.

Sorry for yet another rant, but I feel obliged to share these kind of experiences so others out there don’t feel alone.